SBI Retail Bonds for investors | SBI bonds 2011 download

This time we’re going to cover the recently announced SBI retail bonds, and if last time was any indication these will become hot as hell when they open for subscription.

For this post I’m going to cover the features of these SBI Retail bonds, and then answer some questions leveraging what people asked last time around.

SBI Retail Bonds

SBI Retail Bonds: Open and Close Date

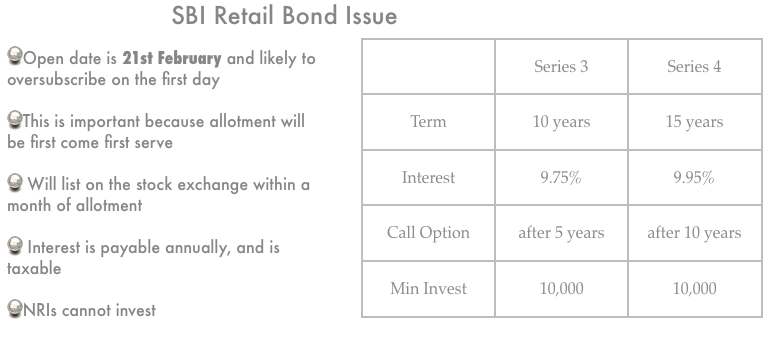

I think only the open date is important in this issue because last time around the issue got over-subscribed the first day itself, and it’s quite likely that it gets over-subscribed this time again.

The open date for Tranche 1 is February 21, 2011 and close date is February 28 2011.

If you decide to buy these bonds, then I’d highly recommend doing so on February 21st itself. If you’re not able to buy them on February 21st then make sure to check how much they have been over-subscribed by since these SBI bonds are on first come first serve basis, and there might be no point in applying for them after the 21st.

Interest Rate on the SBI Retail Bonds

For retail investors these bonds will pay out 9.75% for the 10 years series, and 9.95% for the 15 years series.

| 10 years | 15 years |

| 9.75% | 9.95% |

There are banks that give you 10% for fixed deposits, but none of them allow you to lock in to that rate for this long a period. In that sense – these SBI bonds are offering quite a good deal compared to whatever is available at present.

I say at present because that’s important. When SBI came out with their retail bond issue last time around – there was a huge demand for that and it was a pretty sweet deal too. But, that was at a lower rate than the current offering, so you don’t know how interest rates are going to look like 5 years from now or 10 years from now.

Your money does get locked in with the SBI bonds since this is not like a fixed deposit that you can break at your will. If you go for the 10 years tenure then it will be redeemed at the end of 10 years.

SBI has the option of redeeming them at the end of 5 years and 10 years as well (more on that later), but they will only do so if the interest rates are lower at that point in time, so in that sense – keep in mind that you are committing to the redemption time period.

SBI Bonds will list on the stock exchange

These bonds are going to list on the stock exchange so you will have the option to sell them in the secondary market even if you can’t redeem them.

Keep in mind though that bond prices move about in the secondary market, so this is not the same as redemption because the prices will depend on the demand and supply plus the interest rates at that time.

Minimum and Maximum Application

The face value of one bond is Rs. 10,000 and that’s the minimum investment for the retail investor. The maximum application amount for the retail investor is Rs. 500,000.

Compulsorily in Dematerialized form

These bonds will not be issued in physical form, so you will need a demat account in order to apply for these bonds. Since this is a short point I’ll add that for the 3 of you who care these are unsecured bonds, but are rated AAA by CRISIL.

Can I get loans against these SBI Retail bonds?

No, you won’t be able to pledge these bonds like fixed deposits, and get loans against them. Similarly, you can’t break them before time like I said earlier.

Can NRIs apply for these bonds?

No, NRIs are not allowed to apply for these bonds.

When will the bonds start trading in the stock exchange?

You won’t have to wait for a long time for the SBI bonds to start trading on the stock exchange. If last time was any indication then the trading will start in less than a month of allotment.

What kind of listing gains can I expect?

I wish I knew because then I could make money without doing any real work, but alas that’s not to be. I’m sure there is going to be a lot of speculation around this, and the only input I can provide is that last time around the SBI retail bonds listed at a 5% premium.

Can I apply for the SBI bonds online?

No, there’s no option of applying for these bonds online – you have to necessarily apply using the physical form.

Is the interest from these bonds tax free?

I’ve had at least a couple of questions last time on this, and I think somehow the fact that the bonds are listed makes some people think that the interest is tax free or that there is no capital gains tax on it. This however, is not true – the interest is taxable, and if you make any capital gains selling the bonds then that’s liable to tax as well.

Where can I buy the SBI bonds from?

You can get the application form in a bank branch, and then fill it and submit it there. Someone told me last time that it helped to go to the bank before hand and get the forms and fill it because of the rush later on. I don’t know how true this will be for everyone, but sounds like a good idea.

What does the call option mean?

There is a call option with this bond which means that for the bond with 10 years tenure SBI has the option to redeem it after 5 years if they want to, and for the bonds with a 15 year tenure SBI has an option of redeeming it in 10 years if they want to.

Remember, this is their option – not yours. They will exercise it if they see it fit, but you can’t ask for buyback after 5 years if you want. In that sense this is different from the infrastructure bonds, which are the other bonds currently selling in the market.

I’ve tried to answer all questions I could think of, and have kept the post as simple as possible. Please feel free to ask any question that I have left out, and I’ll try to answer them, and of course there are a lot of other smart readers who answer questions these days, so you may not even need me.